Degenerate Economy Index™

An ETF concept tracking the markets that move on narrative, velocity, and risk appetite

TradFi + DeFi markets. Degenerate signals. Narrative-driven liquidity. ETF-ready exposure.

The Degenerate Economy ETF™ is designed to track DEGENCOM™, an index that captures the speculative economy - the part of the market where sentiment, memes, and momentum drive price. It surfaces the assets that react fastest when risk turns on and the platforms that profit from that activity.

The index base is derived by setting Bitcoin to 1 BTC at the Oct 4, 2024 close and scaling the total by its index weight; all other holdings are sized from that base according to their weights.

DEGENCOM™ is a thematic, actively governed index that can incorporate the latest meme-driven and high‑velocity names when warranted by the rules and signals.

Our mission is to democratize finance by building an ETF concept that can be accessible to everyone, subject to regulatory approval and partner support.

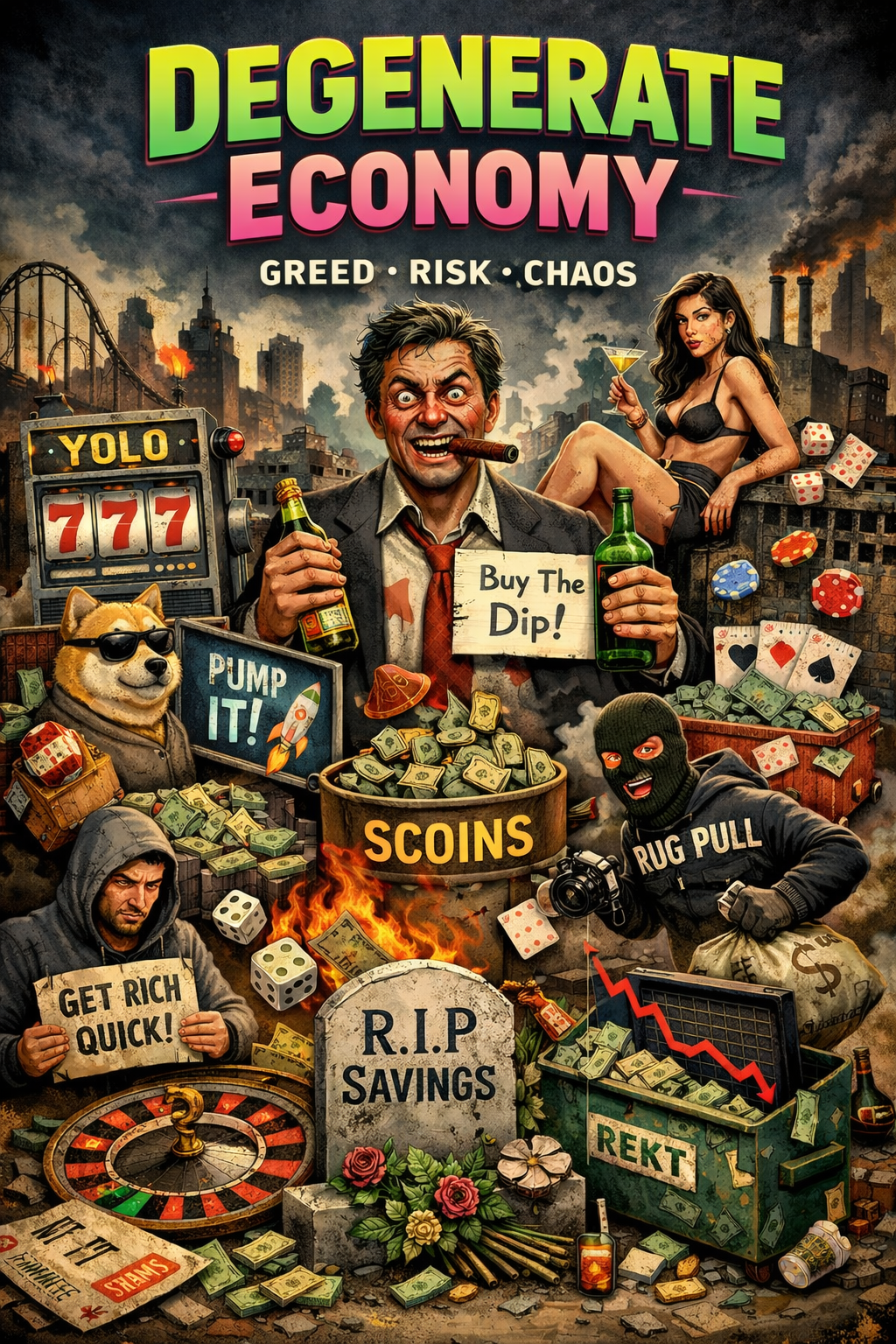

Disclaimer: The poster artwork is satirical and illustrative only. Any “get rich quick” references are fictional and not intended to depict real investment outcomes. This content is not investment advice, an offer, or a solicitation to buy or sell securities. Investing involves risk of loss, and past performance is not indicative of future results.

Why the Index

The degenerate economy is real and it moves fast

As described by Stocktwits, the degenerate economy is where trading, ownership, and gambling blur into a smartphone-first lifestyle. DEGENCOM™ exists to track that behavior in real time by focusing on the companies and assets that enable it - from digital wallets and trading apps to exchanges and platforms that monetize participation.

The index was created on Oct 4, 2024 to map the infrastructure of speculation - exchanges, platforms, and high-beta leaders that monetize participation as it accelerates. We treat it as a barometer: when the degenerate economy accelerates, DEGENCOM™ becomes a live signal. When it slows, the index shows where the momentum drained first.

The index focuses on the “arms dealers” of speculation: platforms, exchanges, and technology backbones that benefit regardless of which meme or asset leads the cycle. The thesis is that the infrastructure keeps growing even as specific fads rotate.

It is a thematic, actively governed index that can add high‑velocity meme names when warranted by signals. The methodology is designed to remain investable, transparent, and ETF‑ready while capturing the most reflexive parts of modern markets.

What DEGENCOM™ Means

Short for degenerate - the high-risk, high-attention corner of the market.

Economy and community - the social engine that powers speculative cycles.

Together, DEGENCOM™ stands for the degenerate economy: the collective, sentiment-driven layer of modern markets.

Created Oct 4, 2024 by Howard Lindzon to track the infrastructure of speculation.

Built around 13 public companies plus Bitcoin, with limited turnover since inception.

Includes platforms, exchanges, and technology leaders that profit from market participation.

Designed to reflect the participation of hundreds of millions of new market entrants.

Reported +130% since inception as of Oct 17, 2025 (Forbes).

What It Tracks

Signals that define the degenerate economy

The index focuses on assets that consistently show reflexive behavior. These signals explain why the index moves when it does.

Volatility Amplifiers

Names that consistently trade with elevated realized volatility, wide ranges, and fast mean reversion.

Narrative Velocity

Sectors and platforms where social momentum, launch cycles, or speculation move prices faster than fundamentals.

Liquidity + Participation

Sufficient liquidity and active retail participation to reflect real-time sentiment shifts.

Infrastructure Capture

The rails, exchanges, and platforms that collect revenue regardless of which assets win the headline moment.

Semiconductors + Infrastructure

The tools that enable speculation: compute, exchanges, and rails.

Consumer Platforms

Networks where retail narratives form and accelerate.

Crypto-Adjacent

On-ramps, brokers, and platforms tied to digital asset liquidity cycles.

High-Beta Innovators

Companies with asymmetric sensitivity to risk-on sentiment.

The index infrastructure mix includes technology backbones (Alphabet, Apple), trading platforms (Robinhood, Coinbase), derivatives venues (CME Group, Cboe Global Markets, Intercontinental Exchange), a semiconductor ETF (SMH), gaming and consumer momentum (Sea Ltd, Roblox, Deckers), sports betting (DraftKings), and Bitcoin as the original 24/7 speculative asset.

Constituents are reviewed during scheduled rebalances and may change as regimes evolve.

The Degenerate Economy Index™ can span public equities, crypto exposure (Bitcoin and crypto-adjacent equities), options and derivatives infrastructure, brokerages, payments and on-ramps, gaming and sports betting platforms, and fintech/data infrastructure tied to speculative participation. Globally investable asset classes include public equities, fixed income, and cash, plus FX, commodities, real assets (real estate, infrastructure, natural resources), private capital (private equity/venture, private credit), hedge funds, and digital assets.

This describes the broader investable universe. DEGENCOM™ maintains a stock‑index mandate with ETF‑ready requirements; inclusion is limited to eligible public equities and related, index‑approved exposures.

Inclusion is subject to index rules, liquidity, and regulatory constraints.

Methodology

How the index is built

DEGENCOM™ blends quant signals with thematic oversight to track the infrastructure of speculation without chasing noise. The methodology defines a core, liquid basket of public equities that enable speculative participation — exchanges, brokers, payments, platforms, and key technology backbones. That core is shaped by rules around liquidity, tradability, and risk caps, with scheduled reviews and interim checks during regime shifts.

When the signals align — narrative velocity, participation surges, and liquidity thresholds — the index can add meme‑driven or high‑velocity names within defined bands. These sleeves are rules‑based, time‑boxed when needed, and rebalanced against the infrastructure core so the index stays ETF‑ready, repeatable, and investable across market cycles.

Start with liquid, exchange-traded assets and thematic equities tied to speculative behavior.

Blend volatility, volume spikes, and sentiment velocity into a composite DEGENCOM™ score.

Apply caps and sector balance rules to avoid single-name or single-theme dominance.

Monthly refresh with interim checks when volatility regimes shift materially.

Thematic ETF

Why thematic investing fits DEGENCOM™

Thematic ETFs are built around structural trends rather than traditional sector labels. The degenerate economy is one of those structural shifts - a persistent layer of markets shaped by retail participation, social velocity, and platform-driven access.

We are also exploring a high income ETF concept that uses options premiums on index holdings to target monthly income, alongside the core index-tracking ETF.

An index designed for ETF delivery

The ETF platform is designed for two launches: a core index‑tracking Degenerate Economy ETF™ and an income‑focused ETF concept that overlays options premiums on index holdings. Both are built on the same DEGENCOM™ foundation with rules‑based oversight and liquidity screening.

ETF shares trade on exchange at market prices and may trade above or below NAV.

Index Snapshot

Latest reported index facts

The snapshot below reflects reported index facts. The proxy tracker uses Twelve Data daily closes and public constituent references to illustrate historical performance back to Oct 4, 2024. It is not the official index and is provided for informational purposes only.

Management

Degenerate Economics Management™

Degenerate Economics Management™ is a leader in ETF advisory and sub-advisory services. We work directly with issuers to design, govern, and sub-advise differentiated exposures across equity, options income, and thematic strategies. Our mission is to translate market structure changes into transparent, rules-based ETF opportunities that can democratize access to the degenerate economy for all investors.

Our leadership team includes seasoned ETF, indexing, and market-structure professionals with backgrounds spanning asset management, research, and product development.

We partner with ETF issuers and asset managers to deliver index licensing, sub-advisory oversight, and launch-ready product blueprints. Our process blends quantitative signals with human governance, ensuring strategies remain investable and compliant.

Initially, we serve institutional partners, advisors, and accredited investors seeking active thematic ETF exposure. Our goal is to democratize finance by bringing ETF access to everyone, subject to regulatory approval and partnerships.

Our team includes capital markets traders, sales traders, and brokers with deep experience across equities, ETFs, and credit derivatives. The group has led electronic market innovation, including early ADR swap marketplaces and one of the first successful electronic CDS trading platforms.

One team leader has a long track record in ETF product design, index sponsorship, and portfolio management, including the creation of widely recognized options‑based strategies and collaboration with major exchanges to operationalize index methodologies for real‑world ETF delivery.

The leadership group has built and advised ETF products, created index providers and sponsors, and designed derivative overlays for exchange‑traded funds. Experience spans portfolio management, product structuring, institutional research, and multi‑billion‑dollar ETF launches.

Another team leader has served as a broker‑dealer executive with supervisory authority, building and running front‑, middle‑, and back‑office operations while implementing global FIX connectivity and execution workflows for institutional trading desks worldwide.

The team has co‑founded and scaled an overnight U.S. equity trading venue, operating as a regulated broker‑dealer and ATS that provides compliant, transparent access to U.S. listed stocks, ADRs, and ETFs during the Asia business day. This work sits at the intersection of 24‑hour U.S. trading, global FIX connectivity, and the bridge between TradFi and digital‑asset markets.

We bring institutional execution expertise across block trading, hybrid high‑/low‑touch workflows, and client onboarding, along with front‑to‑back operating leadership in compliance, risk management, supervisory oversight, and financial IT infrastructure.

Additional experience includes private‑market deal structuring, pre‑IPO access, and multi‑family office investing across fintech, biotech, digital assets, Web3, and commercial real estate.

This team overview is provided for informational purposes only and is not investment advice or an offer. Views expressed are personal and may not reflect the views of affiliated firms.

FAQ

Frequently asked questions

Common questions about DEGENCOM™, the ETF concept, and our management approach.

Not yet. We need issuer partnerships, service provider support, and regulatory review before launch. The goal is an ETF that can be available to everyone.

It tracks the infrastructure of speculation: platforms, exchanges, and technology backbones that benefit from trading and participation cycles.

The index is reviewed monthly with interim checks during significant volatility regime shifts.

Degenerate Economics Management™ is the index sponsor and advisory lead. We set the methodology, governance, and research agenda, and engage sub-advisors when specialized expertise is required.

It does not chase memes. The methodology can add meme-driven names when warranted by rules and signals, but it remains anchored to infrastructure, liquidity, and risk controls.

Initially for institutional partners, advisors, and accredited investors seeking active thematic ETF exposure. The goal is to bring the ETF to everyone and democratize finance, subject to regulatory approval and partnerships.

It can. The index may include Bitcoin and crypto-adjacent equities, plus options and derivatives infrastructure, alongside equities, platforms, and other speculative economy assets.

Ready to talk about DEGENCOM™?

Reach out to discuss licensing, data access, or index partnerships. We keep the contact flow simple and private.